A large number of Americans, some 26 million, do not have a credit score, and 19 million more are with outdated data and are excluded from lending. That means that somewhere around 45 million Americans are unable to apply for, or finance, a loan for any kind of purchase — auto or home.

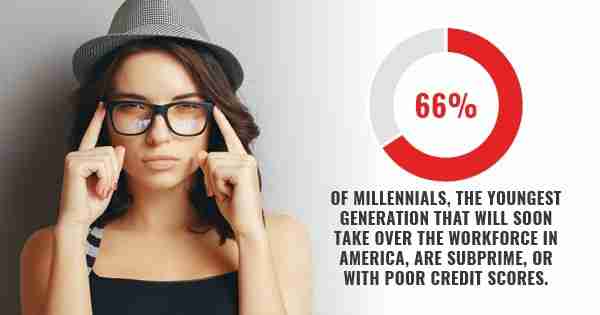

Moreover, 66% of millennials, the youngest generation that will soon take over the workforce in America, are subprime, or with poor credit scores.

That means that if they wanted to purchase a vehicle, they would be unable to. Without a large downpayment, or paying in full, they’re not able to get the financing to purchase a car or home. The can’t get a loan from the bank because they have no reliable credit history with which to qualify.

That’s where subprime loans come in.

Subprime buyers are those that have credit scores of 500 to 600, and those with scores ranging from 300 to 500 are considered deep subprime.

Subprime loans can help generate new leads for auto sales by giving the younger generation, and those with poor credit scores or no scores at all, the ability to finance their vehicle. This may come at the price of a larger downpayment, but they would be able to afford a new or used car.

These loans have become more and more prominent as the banks begin to increase their requirements, further restricting who can and cannot get a loan through them. So, with traditional avenues no longer available, the millennial crowd turns to their number one source of information: the internet.

Auto internet leads are one of the fastest growing ways that people find out about cars and loans, especially subprime loans. These subprime leads can be funneled directly to your business by utilizing lenders that will work with auto dealers to increase business. New leads for auto loans come about this way every day, especially as more and more people find they can’t get a car using their bank.

Due to the costs associated with vehicles, these would be used car leads, as the average loaner debt has grown considerably — somewhere around $17,966, on average. This would mean more business for used car dealers, more purchases and more money circulating in the economy, and ultimately, more growth.

If you have any questions about new leads for auto loans via the internet or subprime auto loans, contact us and we’ll be happy to assist you!